Qualifying taxpayers are invited to receive free tax preparation and electronic filing of their 2023 federal and state income tax returns at the University of Wisconsin-Whitewater Volunteer Income Tax Assistance clinic. This IRS-sponsored program is available for low and moderate-income taxpayers at no cost, and no appointments are needed.

The UW-Whitewater VITA clinic will be located in the UW-W Community Engagement Center, 1260 W Main Street, Whitewater (next to Walmart). There is plenty of free parking in front of the UW-W Community Engagement Center for VITA participants. Clinic hours are from 3:30 p.m. to 6:00 p.m. on Wednesdays from January 31 through April 10. Clients will be served on a first-come, first-served basis and they should arrive at least one hour before closing.

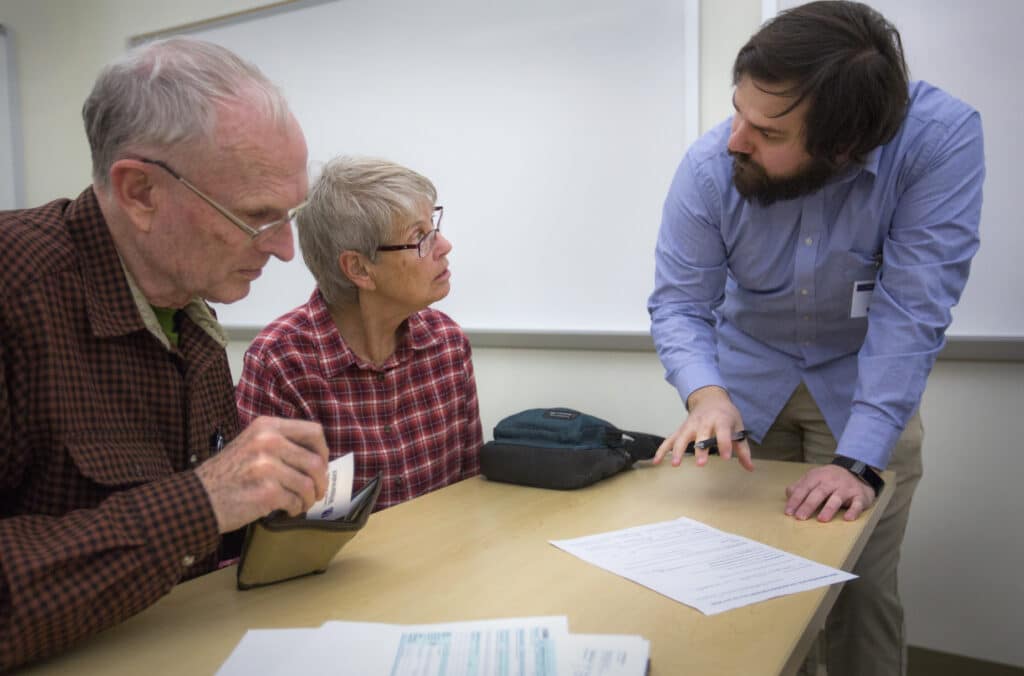

The VITA clinic is staffed by certified student preparers and supervised by faculty in the College of Business and Economics Department of Accounting. In addition to providing hands-on experience for graduate and undergraduate accounting students, the free VITA clinic helps residents of Whitewater and surrounding communities.

“We have many long-time clients who return for assistance each spring,” said Robert Meyers, accounting department lecturer and VITA program co-director. “The opportunity to apply training while working with real people is an invaluable experience for our students.”

Important information, including a location map, program limitations and required supporting documentation, can be found at https://www.uww.edu/cobe/vita. For additional information, email the VITA Site Coordinator at vita@uww.edu or leave a message at 262-472-5452.